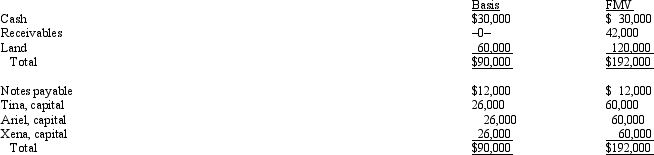

Tina sells her 1/3 interest in the TAX Partnership to James for $60,000 cash plus the assumption of Tina's $4,000 share of partnership debt.On the sale date,the partnership balance sheet and agreed-upon fair market values were as follows:  As a result of the sale,Tina recognizes:

As a result of the sale,Tina recognizes:

A) No gain or loss.

B) $34,000 capital gain.

C) $38,000 capital gain.

D) $14,000 ordinary income and $20,000 capital gain.

E) $14,000 capital gain and $24,000 ordinary income.

Correct Answer:

Verified

Q135: Which of the following is not typically

Q136: Which of the following statements about the

Q137: Paul is a 25% owner in the

Q138: In a proportionate liquidating distribution,Barbara receives a

Q139: Which of the following is not true

Q141: The MOP Partnership is involved in leasing

Q141: Harry and Sally are considering forming a

Q143: Joe has a 25% capital and profits

Q144: Meagan is a 40% general partner in

Q145: Cindy is a 5% limited partner in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents