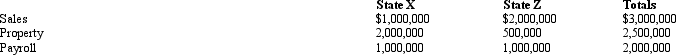

Mandy Corporation realized $1,000,000 taxable income from the sales of its products in States X and Z.Mandy's activities establish nexus for income tax purposes only in Z.Mandy's sales,payroll,and property among the states include the following.  X utilizes a double-weighted sales factor in its three-factor apportionment formula.How much of Mandy's taxable income is apportioned to X?

X utilizes a double-weighted sales factor in its three-factor apportionment formula.How much of Mandy's taxable income is apportioned to X?

A) $1,000,000.

B) $543,333.

C) $490,000.

D) $0.

Correct Answer:

Verified

Q44: Wailes Corporation is subject to a corporate

Q55: José Corporation realized $600,000 taxable income from

Q57: Perez Corporation is subject to tax only

Q59: Under P.L. 86-272, which of the following

Q59: The typical state sales/use tax falls on

Q60: Under P.L.86-272, which of the following transactions

Q60: José Corporation realized $600,000 taxable income from

Q62: Judy,a regional sales manager,has her office in

Q63: In determining taxable income for state income

Q95: A state sales tax usually falls upon:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents