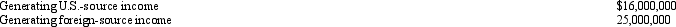

Austin,Inc. ,a domestic corporation,generates U.S.-source and foreign-source gross income.Austin's assets (tax book value)are as follows.

Austin incurs interest expense of $180,000.Using the asset method and the tax book value,apportion interest expense to foreign-source income.

Austin incurs interest expense of $180,000.Using the asset method and the tax book value,apportion interest expense to foreign-source income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q127: Which of the following statements regarding the

Q128: USCo, a domestic corporation, has worldwide taxable

Q130: During 2010,Martina,an NRA,receives interest income of $50,000

Q131: Which of the following statements best describes

Q133: History,Inc. ,a domestic corporation,owns 60% of the

Q137: Which of the following income items does

Q137: Which of the following items of CFC

Q138: BendCo,Inc. ,a U.S.corporation,has foreign-source income and pays

Q142: KeenCo, a domestic corporation, is the sole

Q158: Arendt, Inc., a domestic corporation, purchases a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents