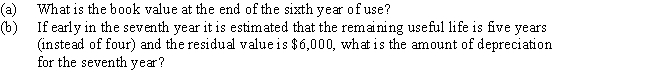

Equipment costing $80,000 with a useful life of 10 years and a residual value of $8,000 has been depreciated for six years by the straight-line method.Assume a fiscal year ending December 31.

Correct Answer:

Verified

Q161: Match the intangible assets described with their

Q167: Match each account name to the financial

Q170: Match each account name to the financial

Q173: Match each account name to the financial

Q182: Copy equipment was acquired at the beginning

Q183: Machinery is purchased on July 1 of

Q185: Convert each of the following estimates of

Q186: Prior to adjustment at the end of

Q191: Computer equipment was acquired at the beginning

Q198: On July 1, Hartford Construction purchases a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents