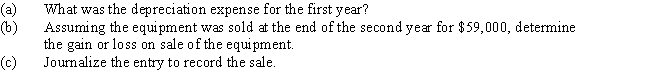

Equipment was acquired at the beginning of the year at a cost of $75,000.The equipment was depreciated using the straight-line method based on an estimated useful life of six years and an estimated residual value of $7,500.

Correct Answer:

Verified

(Cost - Residual Value)/Use...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q209: Carter Co.acquired drilling rights for $18,550,000.The oil

Q210: Solare Company acquired mineral rights for $60,000,000.The

Q211: On the first day of the fiscal

Q213: Equipment acquired on January 2,Year 1,at a

Q213: On December 31, Bowman Company estimated that

Q214: On December 31,it was estimated that goodwill

Q215: Champion Company purchased and installed carpet in

Q216: Financial statement data for the years ended

Q218: Computer equipment

(office equipment)purchased 6½ years ago

Q219: Chasteen Company acquired mineral rights for $9,100,000.The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents