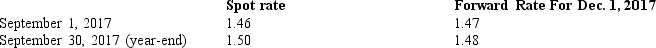

On September 1,2017,Mudd Plating Company entered into two forward exchange contracts to purchase 250,000 euros each in 90 days.The relevant exchange rates are as follows:  The first forward contract was to hedge a purchase of inventory on September 1,payable on December 1.On September 30,what amount of foreign currency transaction loss should Mudd Plating report in income?

The first forward contract was to hedge a purchase of inventory on September 1,payable on December 1.On September 30,what amount of foreign currency transaction loss should Mudd Plating report in income?

A) $0.

B) $2,500.

C) $5,000.

D) $10,000.

Correct Answer:

Verified

Q5: A transaction gain or loss at the

Q6: The discount or premium on a forward

Q7: A transaction loss would result from:

A) an

Q10: Greco, Inc. a U.S. corporation, bought machine

Q12: A transaction gain or loss is reported

Q13: The exchange rate quoted for future delivery

Q15: During 2017, a U.S. company purchased inventory

Q16: An indirect exchange rate quotation is one

Q17: Madison Paving Company purchased equipment for 350,000

Q19: Montana Corporation a U.S. company, contracted to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents