Consider the following information:

1.On November 1,2017,a U.S.firm contracts to sell equipment (with an asking price of 500,000 pesos)in Mexico.The firm will take delivery and will pay for the equipment on February 1,2018.

2.On November 1,2017,the company enters into a forward contract to sell 500,000 pesos for $0.0948 on February 1,2018.

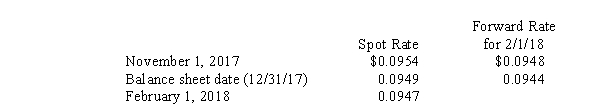

3.Spot rates and the forward rates for February 1,2018,settlement were as follows (dollars per peso):

4.On February 1,the equipment was sold for 500,000 pesos.The cost of the equipment was $20,000.

4.On February 1,the equipment was sold for 500,000 pesos.The cost of the equipment was $20,000.

Required:

Prepare all journal entries needed on November 1,December 31,and February 1 to account for the forward contract,the firm commitment,and the transaction to sell the equipment.

Correct Answer:

Verified

Q24: On October 1, 2016, Philly Company purchased

Q24: On November 1,2017,National Company sold inventory to

Q25: Kettle Company purchased equipment for 375,000 British

Q26: On July 15, Pinta, Inc. purchased 88,500,000

Q27: On December 1,2016,Dorn Corporation agreed to purchase

Q28: On November 1,2017,Cone Company sold inventory to

Q31: On April 1,2017,Manatee Company entered into two

Q32: Imperial Corp.,a U.S.corporation,entered into a contract on

Q32: Accounting for a foreign currency transaction involves

Q33: On November 1,2016,Jagged Company sold inventory to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents