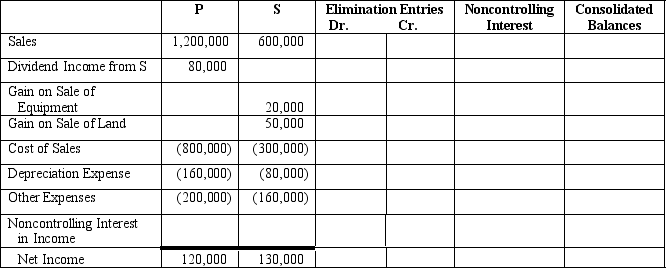

P Corporation acquired 80% of the outstanding voting stock of S Corporation when the fair values equaled the book values.

On July 1,2016,P sold land to S for $300,000.The land originally cost P $200,000.S recently resold the land on October 30,2017 for $350,000.

On October 1,2017,S Corporation sold equipment to P Corporation for $80,000.S originally paid $100,000 for this equipment and had accumulated depreciation of $40,000 thus far.The equipment has a five-year remaining life.

Required:

A.Complete the consolidated income statement for P Corporation and subsidiary for the year ended December 31,2017.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: In the year an 80% owned subsidiary

Q21: When there have been intercompany sales of

Q23: On January 1, 2016, Pound Company acquired

Q25: Pale Company owns 90% of the outstanding

Q27: On January 1, 2016, P Corporation sold

Q28: Pine Company, a computer manufacturer, owns 90%

Q29: P Company bought 60% of the common

Q30: P Corporation acquired an 80% interest in

Q32: P Company purchased land from its 80%

Q33: On January 1, 2008, Perry Company purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents