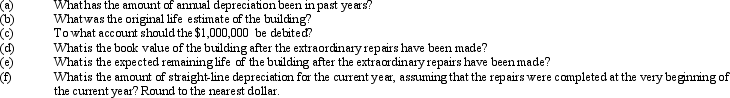

A number of major structural repairs completed at the beginning of the current fiscal year at a cost of $1,000,000 are expected to extend the life of a building 10 years beyond the original estimate. The original cost of the building was $6,552,000, and it has been depreciated by the straight-line method for 25 years. Estimated residual value is negligible and has been ignored. The related accumulated depreciation account after the depreciation adjustment at the end of the preceding fiscal year is $4,550,000.

Correct Answer:

Verified

Q122: An asset was purchased for $58,000 and

Q142: Equipment was purchased on January 5, 2011,

Q143: Fill in the missing numbers using the

Q144: Williams Company acquired machinery on July 1,

Q145: For each of the following fixed assets,

Q147: Equipment purchased at the beginning of the

Q148: Equipment was acquired at the beginning of

Q149: Journalize each of the following transactions:

Q151: Convert each of the following estimates of

Q156: Falcon Company acquired an adjacent lot to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents