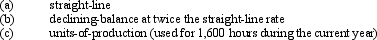

Machinery is purchased on July 1 of the current fiscal year for $240,000. It is expected to have a useful life of 4 years, or 25,000 operating hours, and a residual value of $15,000. Compute the depreciation for the last six months of the current fiscal year ending December 31 by each of the following methods:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q151: Determine the depreciation, for the year of

Q151: Convert each of the following estimates of

Q152: Solare Company acquired mineral rights for $60,000,000.

Q154: Financial Statement data for the years ended

Q155: Equipment acquired on January 2, 2011 at

Q157: XYZ Co. incurred the following costs related

Q158: On the first day of the fiscal

Q159: Equipment acquired at a cost of $126,000

Q160: Macon Co. acquired drilling rights for $7,500,000.

Q161: Computer equipment (office equipment) purchased 6 1/2

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents