Norton Company is considering a project that will require an initial investment of $750,000 and will return $200,000 each year for five years.

Required:

If taxes are ignored and the required rate of return is 9%, what is the project's net present value? Based on this analysis, should Norton Company proceed with the project?

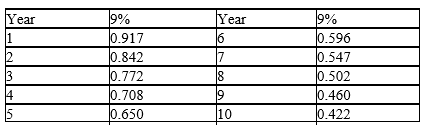

Below is a table for the present value of $1 at compound interest.

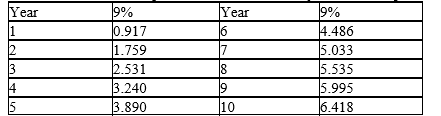

Below is a table for the present value of an annuity of $1 at compound interest.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q129: Assume in analyzing alternative proposals that Proposal

Q136: Below is a table for the present

Q137: Below is a table for the present

Q140: The production department is proposing the purchase

Q143: A project is estimated to cost $273,840

Q144: A project has estimated annual cash flows

Q149: An 6-year project is estimated to cost

Q152: The process by which management allocates available

Q155: An 8-year project is estimated to cost

Q160: A company is contemplating investing in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents