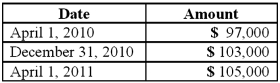

On April 1, 2010, Shannon Company, a U.S. company, borrowed 100,000 euros from a foreign bank by signing an interest-bearing note due April 1, 2011. The dollar value of the loan was as follows:

How much foreign exchange gain or loss should be included in Shannon's 2010 income statement?

A) $3,000 gain.

B) $3,000 loss.

C) $6,000 gain.

D) $6,000 loss.

E) $7,000 gain.

Correct Answer:

Verified

Q23: A forward contract may be used for

Q28: When a U.S. company purchases parts from

Q34: A U.S. company buys merchandise from a

Q36: On December 1, 2011, Keenan Company, a

Q36: A U.S. company sells merchandise to a

Q38: Which of the following statements is true

Q42: On May 1, 2011, Mosby Company received

Q42: Winston Corp., a U.S. company, had the

Q55: Larson Company, a U.S.company, has an India

Q60: Williams, Inc., a U.S.company, has a Japanese

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents