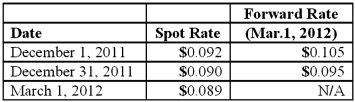

On December 1, 2011, Joseph Company, a U.S. company, entered into a three-month forward contract to purchase 50,000 pesos on March 1, 2012, as a fair value hedge of a foreign currency denominated account payable. The following U.S. dollar per peso exchange rates apply:

Joseph's incremental borrowing rate is 12 percent. The present value factor for two months at an annual interest rate of 12 percent is .9803. Which of the following is included in Joseph's December 31, 2011 balance sheet for the forward contract?

A) $5,146.58 asset.

B) $5,146.58 liability.

C) $500.00 liability.

D) $490.15 asset.

E) $490.15 liability.

Correct Answer:

Verified

Q42: Winston Corp., a U.S. company, had the

Q45: Woolsey Corporation, a U.S. company, expects to

Q46: On April 1, Quality Corporation, a U.S.

Q47: Atherton, Inc., a U.S. company, expects to

Q50: Woolsey Corporation, a U.S. company, expects to

Q51: On May 1, 2011, Mosby Company received

Q53: On March 1, 2011, Mattie Company received

Q53: Parker Corp., a U.S. company, had the

Q54: Winston Corp., a U.S. company, had the

Q59: Primo Inc., a U.S. company, ordered parts

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents