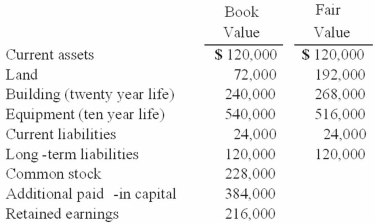

On January 1, 2010, Cale Corp. paid $1,020,000 to acquire Kaltop Co. Kaltop maintained separate incorporation. Cale used the equity method to account for the investment. The following information is available for Kaltop's assets, liabilities, and stockholders' equity accounts:

Kaltop earned net income for 2010 of $126,000 and paid dividends of $48,000 during the year.

At the end of 2010, the consolidation entry to eliminate Cale's accrual of Kaltop's earnings would include a credit to Investment in Kaltop Co. for

A) $124,400.

B) $126,000.

C) $127,000.

D) $76,400.

E) $0.

Correct Answer:

Verified

Q2: Racer Corp. acquired all of the common

Q5: Which one of the following accounts would

Q5: Push-down accounting is concerned with the

A) impact

Q8: Cashen Co. paid $2,400,000 to acquire all

Q9: Which of the following internal record-keeping methods

Q10: On January 1, 2010, Cale Corp. paid

Q11: On January 1, 2010, Franel Co. acquired

Q13: Jansen Inc. acquired all of the outstanding

Q14: On January 1, 2010, Franel Co. acquired

Q17: On January 1, 2010, Cale Corp. paid

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents