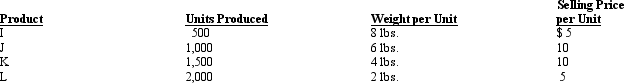

Foster Company incurred $200,000 to manufacture the following products in a joint process:  How much joint cost would be allocated to Product K based on the total sales value method?

How much joint cost would be allocated to Product K based on the total sales value method?

A) $13,334

B) $80,000

C) $26,666

D) $60,000

Correct Answer:

Verified

Q31: Which of the following methods allocates joint

Q111: Deli Products produces two products, X and

Q114: Figure 7-7 Eden Company manufactures two products,

Q115: Suppose that a sawmill processes logs into

Q117: Iles Corporation produces four products in a

Q118: Foster Company incurred $200,000 to manufacture the

Q120: Suppose that a sawmill processes logs into

Q121: Duff Company uses a job-order costing system

Q131: The sales-value-at-split-off method allocates joint production costs

Q142: Which of the following methods allocates a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents