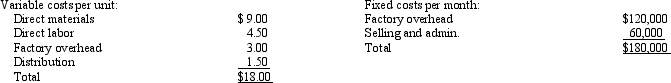

Miller Company produces speakers for home stereo units.The speakers are sold to retail stores for $30.Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail stores.The current production and sales volume is 20,000 per year.Capacity is 25,000 units per year.

The variable distribution costs are for transportation to the retail stores.The current production and sales volume is 20,000 per year.Capacity is 25,000 units per year.

A Tennessee manufacturing firm has offered a one-year contract to supply speaker parts at a cost of $16.00 per unit.If Miller Company accepts the offer, it will be able to rent unused space to an outside firm for $18,000 per year.All other information remains the same as the original data.

-What is the effect on profits if Miller Company buys from the Tennessee firm?

A) decrease of $19,000

B) increase of $19,000

C) increase of $38,000

D) decrease of $6,000

Correct Answer:

Verified

Q34: Firms may be asked to accept a

Q46: The following information pertains to Ewing Company's

Q47: Miller Company produces speakers for home stereo

Q48: Harris Company uses 5,000 units of part

Q49: Figure 17-2 Walton Company manufactures a product

Q52: The following information pertains to the Ewing

Q53: Figure 17-1 The following information pertains to

Q54: Figure 17-1 The following information pertains to

Q55: The operations of Knickers Corporation are divided

Q56: The operations of Smits Corporation are divided

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents