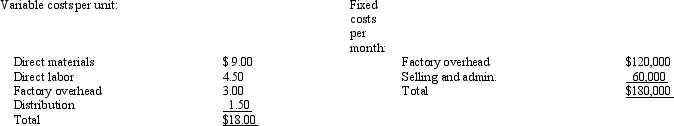

Miller Company produces speakers for home stereo units.The speakers are sold to retail stores for $30.Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail stores.The current production and sales volume is 20,000 per year.Capacity is 25,000 units per year.

The variable distribution costs are for transportation to the retail stores.The current production and sales volume is 20,000 per year.Capacity is 25,000 units per year.

-

An Atlanta wholesaler has proposed to place a special one-time order for 7,000 units at a special price of $25.20 per unit.The wholesaler would pay all distribution costs, but there would be additional fixed selling and administrative costs of $6,000.In addition, assume that overtime production is not possible and that all other information remains the same as the original data.What is the effect on profits if the special order is accepted?

A) increase of $54,900

B) increase of $30,900

C) increase of $36,900

D) increase of $176,400

Correct Answer:

Verified

Q42: If there is excess capacity, the minimum

Q44: If a firm is at full capacity,

Q69: Reggie Corporation manufactures a single product with

Q70: The following information relates to a product

Q71: Stars Manufacturing Company produces Products A1, B2,

Q72: Reggie Corporation manufactures a single product with

Q74: Reggie Corporation manufactures a single product with

Q75: Rose Manufacturing Company had the following unit

Q76: Walton Company manufactures a product with the

Q78: The following information relates to a product

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents