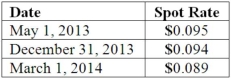

On May 1, 2013, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2014. On May 1, 2013, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2014 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2013. The following spot exchange rates apply:  Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

What was the overall result of having entered into this hedge of exposure to foreign exchange risk?

A) $0

B) $9,000 net loss on the option.

C) $9,000 net gain on the option.

D) $2,000 net gain on the option.

E) $2,000 net loss.

Correct Answer:

Verified

Q28: When a U.S. company purchases parts from

Q34: A U.S. company buys merchandise from a

Q37: A company has a discount on a

Q38: Which of the following statements is true

Q40: On December 1, 2013, Keenan Company, a

Q42: On March 1, 2013, Mattie Company received

Q43: On May 1, 2013, Mosby Company received

Q44: On December 1, 2013, Joseph Company, a

Q45: Winston Corp., a U.S. company, had the

Q46: On April 1, Quality Corporation, a U.S.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents