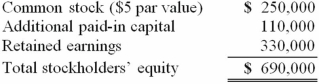

On January 1, 2013, Riney Co. owned 80% of the common stock of Garvin Co. On that date, Garvin's stockholders' equity accounts had the following balances:  The balance in Riney's Investment in Garvin Co. account was $552,000, and the non-controlling interest was $138,000. On January 1, 2013, Garvin Co. sold 10,000 shares of previously unissued common stock for $15 per share. Riney did not acquire any of these shares.

The balance in Riney's Investment in Garvin Co. account was $552,000, and the non-controlling interest was $138,000. On January 1, 2013, Garvin Co. sold 10,000 shares of previously unissued common stock for $15 per share. Riney did not acquire any of these shares.

What is the balance in Investment in Garvin Co. after the sale of the 10,000 shares of common stock?

A) $552,000.

B) $560,000.

C) $460,000.

D) $404,000.

E) $672,000.

Correct Answer:

Verified

Q1: Where do intra-entity sales of inventory appear

Q2: Vontkins Inc. owned all of Quasimota Co.

Q3: Parker owned all of Odom Inc. Although

Q5: How do intra-entity sales of inventory affect

Q5: Where do dividends paid by a subsidiary

Q6: Regency Corp. recently acquired $500,000 of the

Q7: Rojas Co. owned 7,000 shares (70%) of

Q8: On January 1, 2013, Riley Corp. acquired

Q9: Knight Co. owned 80% of the common

Q10: These questions are based on the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents