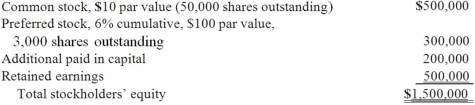

On January 1, 2013, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  Compute the goodwill recognized in consolidation.

Compute the goodwill recognized in consolidation.

A) $800,000.

B) $310,000.

C) $124,000.

D) $0.

E) $(196,000.)

Correct Answer:

Verified

Q21: On January 1, 2013, Nichols Company acquired

Q22: These questions are based on the following

Q23: Which of the following statements is false

Q24: Which of the following statements is true

Q28: If a subsidiary reacquires its outstanding shares

Q29: A subsidiary issues new shares of common

Q29: If newly issued debt is issued from

Q30: Which of the following statements is true

Q31: On January 1, 2013, Nichols Company acquired

Q32: In reporting consolidated earnings per share when

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents