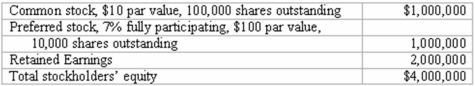

On January 1, 2013, Harrison Corporation spent $2,600,000 to acquire control over Involved, Inc. This price was based on paying $750,000 for 30 percent of Involved's preferred stock, and $1,850,000 for 80 percent of its outstanding common stock. As of the date of the acquisition, Involved's stockholders' equity accounts were as follows:  Assuming Involved's accounts are correctly valued within the company's financial statements, what amount of goodwill should be recognized for the Investment in Involved?

Assuming Involved's accounts are correctly valued within the company's financial statements, what amount of goodwill should be recognized for the Investment in Involved?

A) $(100,000.)

B) $0.

C) $200,000.

D) $812,500.

E) $2,112,500.

Correct Answer:

Verified

Q81: Parent Corporation loaned money to its subsidiary

Q84: What documents or other sources of information

Q86: During 2013, Parent Corporation purchased at book

Q89: Fargus Corporation owned 51% of the voting

Q90: Danbers Co.owned seventy-five percent of the common

Q92: On January 1, 2013, Harrison Corporation spent

Q93: Johnson, Inc. owns control over Kaspar Inc,

Q103: Parent Corporation recently acquired some of its

Q106: Parent Corporation acquired some of its subsidiary's

Q109: Parent Corporation acquired some of its subsidiary's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents