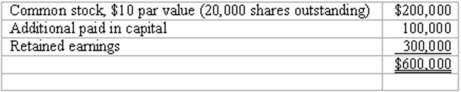

Panton, Inc. acquired 18,000 shares of Glotfelty Corp. several years ago. At the present time, Glotfelty is reporting the following stockholders' equity:

Glotfelty issues 5,000 shares of previously unissued stock to Panton for $35 per share.

Required: Describe how this transaction would affect Panton's books.

The investment price is above the book value of the subsidiary. In this case, however, the additional amount has been paid by the parent company, not by an outside party. Because the payment is made by Panton, the investment account will need an adjustment after recording the cost of the new shares. A change in ownership is accounted for as an equity transaction when controlling interest is retained.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: Thomas Inc. had the following stockholders' equity

Q106: Fargus Corporation owned 51% of the voting

Q107: Thomas Inc. had the following stockholders' equity

Q108: Skipen Corp. had the following stockholders' equity

Q109: Allen Co. held 80% of the common

Q110: Jet Corp. acquired all of the outstanding

Q111: Thomas Inc. had the following stockholders' equity

Q113: Thomas Inc. had the following stockholders' equity

Q114: Panton, Inc. acquired 18,000 shares of Glotfelty

Q115: Panton, Inc. acquired 18,000 shares of Glotfelty

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents