On January 1, 2013, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill which has not been impaired.

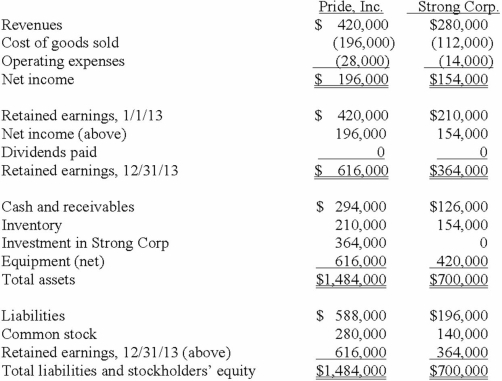

As of December 31, 2013, before preparing the consolidated worksheet, the financial statements appeared as follows:

During 2013, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31, 2013.

What is the total of consolidated cost of goods sold?

A) $196,000.

B) $212,800.

C) $184,800.

D) $203,000.

E) $168,000.

Correct Answer:

Verified

Q19: During 2012, Von Co. sold inventory to

Q20: On January 1, 2013, Race Corp. acquired

Q21: On January 1, 2013, Pride, Inc. acquired

Q22: Strickland Company sells inventory to its parent,

Q23: Walsh Company sells inventory to its subsidiary,

Q25: Dalton Corp. owned 70% of the outstanding

Q26: Walsh Company sells inventory to its subsidiary,

Q27: Walsh Company sells inventory to its subsidiary,

Q28: Walsh Company sells inventory to its subsidiary,

Q29: Strickland Company sells inventory to its parent,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents