Wilson owned equipment with an estimated life of 10 years when it was acquired for an original cost of $80,000. The equipment had a book value of $50,000 at January 1, 2012. On January 1, 2012, Wilson realized that the useful life of the equipment was longer than originally anticipated, at ten remaining years.

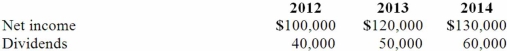

On April 1, 2012 Simon Company, a 90% owned subsidiary of Wilson Company, bought the equipment from Wilson for $68,250 and for depreciation purposes used the estimated remaining life as of that date. The following data are available pertaining to Simon's income and dividends:

Compute the amortization of gain through a depreciation adjustment for 2014 for consolidation purposes.

A) $1,925.

B) $1,825.

C) $2,000.

D) $1,500.

E) $7,000.

Correct Answer:

Verified

Q50: Patti Company owns 80% of the common

Q68: Wilson owned equipment with an estimated life

Q70: On January 1, 2012, Smeder Company, an

Q71: Wilson owned equipment with an estimated life

Q72: Stiller Company, an 80% owned subsidiary of

Q74: Wilson owned equipment with an estimated life

Q75: On January 1, 2012, Smeder Company, an

Q76: Wilson owned equipment with an estimated life

Q77: Gargiulo Company, a 90% owned subsidiary of

Q78: Stiller Company, an 80% owned subsidiary of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents