Several years ago Polar Inc. acquired an 80% interest in Icecap Co. The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values. Polar's acquisition value corresponded to the underlying book value of Icecap so that no allocations or goodwill resulted from the transaction.

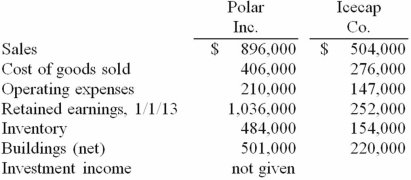

The following selected account balances were from the individual financial records of these two companies as of December 31, 2013:

Polar sold a building to Icecap on January 1, 2012 for $112,000, although the book value of this asset was only $70,000 on that date. The building had a five-year remaining useful life and was to be depreciated using the straight-line method with no salvage value.

Required:

For the consolidated financial statements for 2013, determine the balances that would appear for the following accounts: (1) Buildings (net), (2) Operating expenses, and (3) Non-controlling Interest in Subsidiary's Net Income.

Correct Answer:

Verified

Q117: What is meant by unrealized inventory gains,

Q118: How is the gain on an intra-entity

Q119: Tara Company owns 80 percent of the

Q120: Fraker, Inc. owns 90 percent of Richards,

Q122: Virginia Corp. owned all of the voting

Q123: On January 1, 2013, Musial Corp. sold

Q124: What is the impact on the noncontrolling

Q124: On January 1, 2013, Musial Corp. sold

Q125: Several years ago Polar Inc. acquired an

Q126: Several years ago Polar Inc. acquired an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents