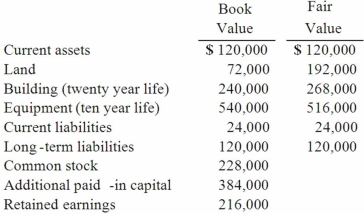

On January 1, 2012, Cale Corp. paid $1,020,000 to acquire Kaltop Co. Kaltop maintained separate incorporation. Cale used the equity method to account for the investment. The following information is available for Kaltop's assets, liabilities, and stockholders' equity accounts on January 1, 2012:  Kaltop earned net income for 2012 of $126,000 and paid dividends of $48,000 during the year.

Kaltop earned net income for 2012 of $126,000 and paid dividends of $48,000 during the year.

In Cale's accounting records, what amount would appear on December 31, 2012 for equity in subsidiary earnings?

A) $77,000.

B) $79,000.

C) $125,000.

D) $127,000.

E) $81,800.

Correct Answer:

Verified

Q1: On January 1, 2012, Cale Corp. paid

Q2: Which one of the following varies between

Q3: On January 1, 2012, Cale Corp. paid

Q5: Push-down accounting is concerned with the

A) impact

Q6: On January 1, 2012, Cale Corp. paid

Q7: Cashen Co. paid $2,400,000 to acquire all

Q8: Cashen Co. paid $2,400,000 to acquire all

Q9: Which of the following internal record-keeping methods

Q10: Parrett Corp. acquired one hundred percent of

Q11: Jansen Inc. acquired all of the outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents