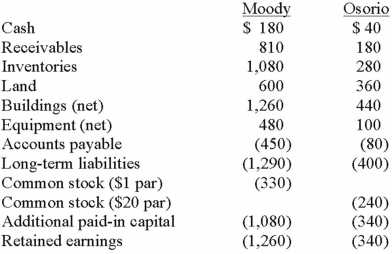

On January 1, 2013, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated equipment at date of acquisition.

A) $480.

B) $580.

C) $559.

D) $570.

E) $560.

Correct Answer:

Verified

Q32: Which of the following statements is true

Q37: The financial statements for Goodwin, Inc. and

Q39: The financial statements for Goodwin, Inc. and

Q40: The financial statements for Goodwin, Inc. and

Q41: On January 1, 2013, the Moody Company

Q43: The financial statements for Goodwin, Inc. and

Q44: Carnes has the following account balances as

Q45: On January 1, 2013, the Moody Company

Q46: The financial balances for the Atwood Company

Q47: Carnes has the following account balances as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents