The following information pertains to questions

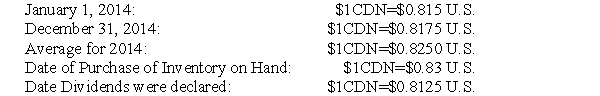

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

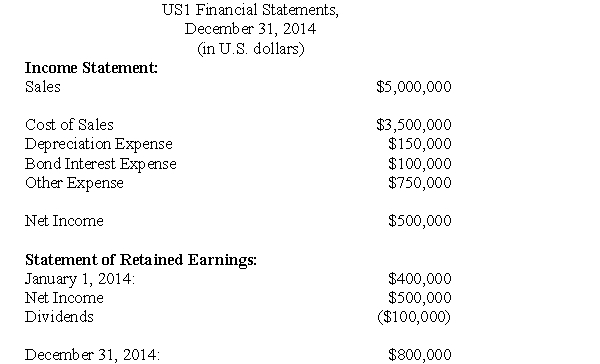

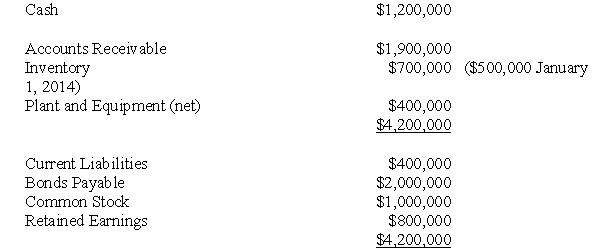

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-What is the amount of the gain or loss arising from translation?

A) A $750 Loss.

B) A $5,000 Loss.

C) A $3,750 Gain.

D) A $307 Loss.

Correct Answer:

Verified

Q24: The following information pertains to questions

ABC

Q25: The following information pertains to questions

ABC

Q26: The following information pertains to questions

ABC

Q27: The following information pertains to questions

ABC

Q28: The following information pertains to questions

ABC

Q30: The following information pertains to questions

ABC

Q31: The following information pertains to questions

ABC

Q32: The following information pertains to questions

ABC

Q33: The following information pertains to questions

ABC

Q34: The following information pertains to questions

ABC

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents