The following information pertains to Questions

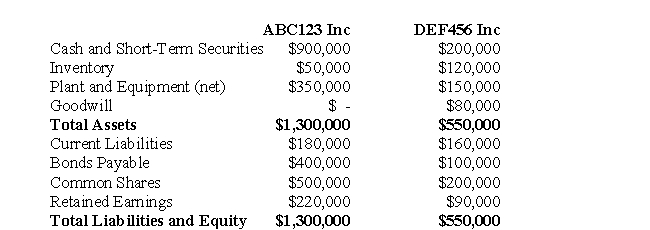

ABC123 Inc has decided to purchase 100% the voting shares of DEF456 for $400,000 in Cash on July1,2008.On the date,the balance sheets of each of these companies were as follows:  On that date,the fair values of DEF456 Assets and Liabilities were as follows:

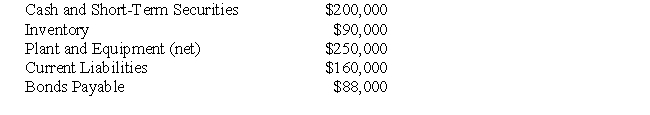

On that date,the fair values of DEF456 Assets and Liabilities were as follows:  In addition to the above,an independent appraiser deemed that DEF456 Inc.had trademarks with a fair market value of $100,000 which had not been accounted for.In turn,ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment,which were said to have Fair Market Values of $30,000 and $480,000,respectively.

In addition to the above,an independent appraiser deemed that DEF456 Inc.had trademarks with a fair market value of $100,000 which had not been accounted for.In turn,ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment,which were said to have Fair Market Values of $30,000 and $480,000,respectively.

-Assume that both companies would be wound up and a new company called ABCDEF Inc.was created in its place.Prepare the Balance Sheet to reflect this occurrence as at July 1,2008.The new entity would have10,000 voting shares issued to the current shareholders for a total market value of $1,222,000.

Correct Answer:

Verified

Q60: Zen Inc.owns 35% of Sun Inc's voting

Q61: The following information pertains to Questions

Telecom

Q62: The following information pertains to Questions

ABC123

Q63: George Peterson is the President of Alpha

Q64: Company Inc.owns all of the outstanding voting

Q66: Assume that X inc)wishes to enter into

Q67: The following information pertains to Questions

ABC123

Q68: Suppose that you worked for Sonic Inc.and

Q69: Great Western Manufacturing Inc.("GWM")was acquired by Great

Q70: Appendix A of IFRS 3 provides an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents