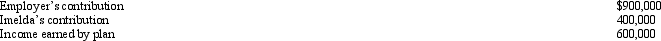

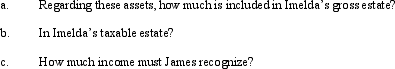

At the time of her death in 2009,Imelda was a participant in her employer's qualified pension plan.Her accrued balance in the plan is:

Imelda also was covered by her employer's group term life insurance program.Her policy (maturity value of $100,000)is made payable to James (Imelda's husband).James is also the designated beneficiary of the pension plan.

Correct Answer:

Verified

Q83: Roger dies on March 3,2009.Which,if any,of the

Q110: Homer and Laura are husband and wife.At

Q112: Barry made taxable gifts as follows: $400,000

Q115: In 1980,Marie and Hal (mother and son)purchased

Q117: Prior to his death in 2009,Rex made

Q118: Regarding the power of appointment estate and

Q118: Pursuant to Corey's will,Emma (Corey's sister) inherits

Q122: Bernard's will passes $800,000 of cash to

Q123: The Federal gift and estate taxes were

Q126: At the time of Cal's death in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents