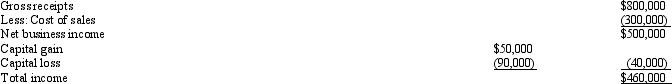

Anthony,an individual calendar year taxpayer,incurred the following transactions.

Assuming that any error in timely reporting these amounts was inadvertent,how much omission from gross income would be required before the six-year statute of limitations would apply?

A) The six-year rule cannot apply here.

B) More than $115,000.

C) More than $137,500.

D) More than $212,500.

Correct Answer:

Verified

Q49: The special tax penalty imposed on appraisers:

A)Applies

Q61: Freddie has been assessed a preparer penalty

Q64: A tax preparer is in violation of

Q68: Which of the following is subject to

Q69: Concerning the penalty for civil fraud applicable

Q71: Concerning a taxpayer's requirement to make quarterly

Q76: Circular 230 allows a tax preparer to:

A)Take

Q79: The Statements on Standards for Tax Services

Q80: Mickey,a calendar year taxpayer,was not required to

Q82: The privilege of confidentiality applies to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents