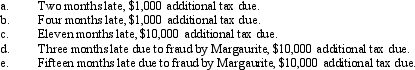

Margaurite did not pay her Federal income tax on time.When she eventually filed the return,she reported a balance due.Compute Margaurite's failure to file penalty in each of the following cases.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Compute the overvaluation penalty for each of

Q84: Rhoda,a calendar year individual taxpayer,files her 2008

Q90: Yin-Li is the preparer of the Form

Q102: List several current initiatives that the IRS

Q106: Carol's AGI last year was $180,000.Her Federal

Q107: Orville,a cash basis,calendar year taxpayer,filed his income

Q112: Dana underpaid his taxes by $150,000.Portions of

Q116: Compute the failure to pay and failure

Q124: Identify a profile for a taxpayer who

Q124: Arnold made a charitable contribution of property

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents