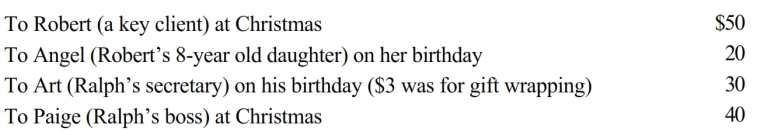

Ralph made the following business gifts during the year.

Presuming proper substantiation, Ralph's deduction is:

A) $0.

B) $53.

C) $73.

D) $78.

E) $98.

Correct Answer:

Verified

Q36: For the spousal IRA provision to apply,

Q37: Distributions from a Roth IRA that are

Q77: Aiden performs services for Lucas. Which, if

Q79: Corey is the city sales manager for

Q81: Fran is a CPA who has a

Q83: Which, if any, of the following expenses

Q85: Which of the following expenses, if any,

Q85: Which of the following miscellaneous expenses is

Q86: The § 222 deduction for tuition and

Q87: During the year, Sophie (a self-employed marketing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents