Rod uses his automobile for both business and personal use and claims the automatic mileage rate for all purposes.

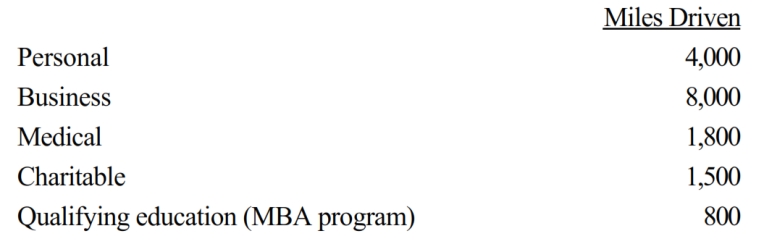

During 2018, his mileage was as follows:

How much can Rod claim for mileage?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: Cathy takes five key clients to dinner

Q106: Myra's classification of those who work for

Q110: Jacob is a landscape architect who works

Q112: If a business retains someone to provide

Q124: Felicia, a recent college graduate, is employed

Q125: Discuss the 50% overall limitation in connection

Q135: Under the automatic mileage method, one rate

Q137: Taylor performs services for Jonathan on a

Q141: In terms of IRS attitude, what do

Q142: Meg teaches the fifth grade at a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents