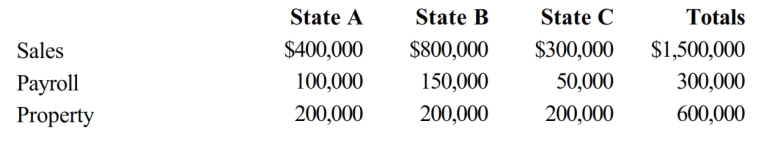

Simpkin Corporation owns manufacturing facilities in States A, B, and C. A uses a three-factor apportionment formula under which the sales, property and payroll factors are equally weighted. B uses a three-factor apportionment formula under which sales are double-weighted. C employs a single-factor apportionment factor, based solely on sales. Simpkin's operations generated $1,000,000 of apportionable income, and its sales and payroll activity and average property owned in each of the three states is as follows.

Simpkin's apportionable income assigned to B is:

A) $1,000,000.

B) $533,333.

C) $475,000.

D) $0.

Correct Answer:

Verified

Q51: The most commonly used state income tax

Q63: General Corporation is taxable in a number

Q64: General Corporation is taxable in a number

Q66: Typically, state taxable income includes:

A) Apportionable income

Q67: Generally, a taxpayer's business income is:

A) Apportioned.

B)

Q69: Chipper Corporation realized $1,000,000 taxable income from

Q70: General Corporation is taxable in a number

Q71: José Corporation realized $900,000 taxable income from

Q72: Generally, nonapportionable income includes:

A) Sales of products

Q73: Marquardt Corporation realized $900,000 taxable income from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents