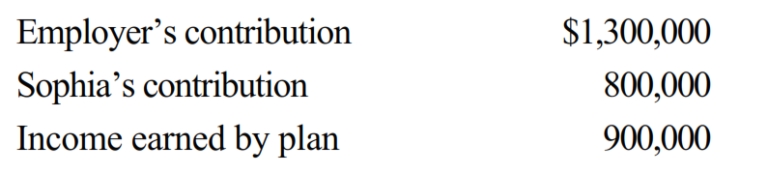

At the time of her death, Sophia was a participant in her employer's qualified pension plan. Her accrued balance in the plan is as follows.

Sophia also was covered by her employer's group term life insurance program. Her policy (maturity value of $100,000) is made payable to Aiden (Sophia's husband). Aiden also is the designated beneficiary of the pension plan.

a. Regarding these assets, how much is included in Sophia's gross estate?

b. In Sophia's taxable estate?

c. How much gross income must Aiden recognize, when collecting on these items?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: On the date of her death, Ava

Q85: Mandy and Hal (mother and son) purchased

Q86: Homer and Laura are husband and wife.

Q87: Concerning the Federal estate tax deduction for

Q88: Matt and Patricia are husband and wife

Q90: Daniel and Mia acquired realty for $2

Q91: Pursuant to Corey's will, Emma (Corey's sister)

Q92: Ben and Lynn are married and have

Q93: In 2015, Thalia purchases land for $900,000

Q94: At the time of her death, Amber

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents