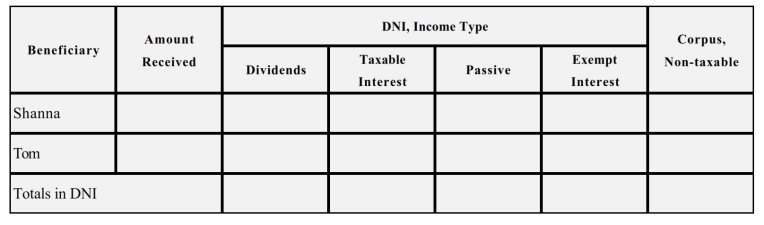

The Willa estate reports $100,000 DNI, composed of $50,000 dividends, $20,000 taxable interest, $10,000 passive income, and $20,000 tax-exempt interest. Willa's two noncharitable income beneficiaries, Shanna and Tom, receive distributions of $75,000 each. How much of each class of income is deemed to have been distributed to Shanna? To Tom? Use the following template to structure your answer.

Correct Answer:

Verified

Q104: A (first-, second-, third-) tier distribution is

Q110: Beginning with its tax year, an estate

Q112: The Form 1041 of a calendar year

Q113: A gift to charity from its 2017

Q115: Dexter established a divorce trust to benefit

Q118: The trustee of the Miguel Trust can

Q119: Counsell is a simple trust that correctly

Q122: Does the estate or trust's distributable net

Q150: You are responsible for the Federal income

Q152: The Gomez Trust is required to distribute

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents