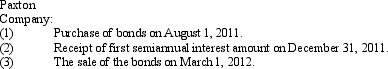

On August 1, 2011, Airport Company sold Paxton Company $1,000,000 of 10-year, 6% bonds, dated July 1 at 100 plus accrued interest. On March 1, 2012, Paxton sold half of the bonds for $520,000 plus accrued interest. Present entries to record the following transactions:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: On February 12, Addison, Inc. purchased 6,000

Q99: The account Unrealized Gain (Loss) on Trading

Q102: Albright Company purchased as a long-term investment

Q109: Journalize the entries to record the following

Q110: The income statement for Dodson Corporation reported

Q111: Gerardo Company had a net income of

Q112: Purchased $400,000 of ABC Co. 5% bonds

Q113: On May 1, 2012, Chase Inc. purchases

Q115: Ramiro Company purchased 40% of the outstanding

Q117: Herberto Company had a net income of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents