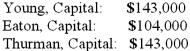

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was Eaton's total share of net loss for the first year?

A) $3,900 loss.

B) $11,700 loss.

C) $10,400 loss.

D) $24,700 loss.

E) $9,100 loss.

Correct Answer:

Verified

Q23: Which of the following is not a

Q31: Jell and Dell were partners with capital

Q32: A partnership began its first year of

Q33: A partnership began its first year of

Q34: A partnership began its first year of

Q35: A partnership began its first year of

Q37: Cleary, Wasser, and Nolan formed a partnership

Q39: A partnership began its first year of

Q40: A partnership began its first year of

Q41: The capital account balances for Donald &

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents