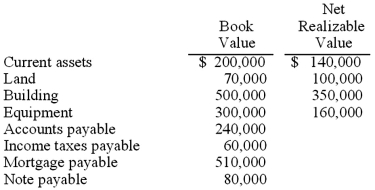

Quincy Corp., about to be liquidated, has the following amounts for its assets and liabilities:  The mortgage is secured by the land and building, and the note payable is secured by the equipment. Quincy expects that the expenses of administering the liquidation will total $40,000. How much should Quincy expect to pay on the accounts payable?

The mortgage is secured by the land and building, and the note payable is secured by the equipment. Quincy expects that the expenses of administering the liquidation will total $40,000. How much should Quincy expect to pay on the accounts payable?

A) $240,000.

B) $128,000.

C) $120,000.

D) $96,000.

E) $146,000.

Assets available for priority claims and unsecured creditors $220,000 - priority claims $100,000 = $120,000 $120,000/$300,000 unsecured = payment of 40% on unsecured dollars. 40% x $240,000 A/P = $96,000

Correct Answer:

Verified

Q2: Which one of the following unsecured liabilities

Q3: Lawyer's fees incurred during a reorganization are

Q5: Which one of the following is a

Q7: On a statement of financial affairs, a

Q8: On its balance sheet, a company undergoing

Q12: In a statement of financial affairs, assets

Q12: Sparkman Co. filed a bankruptcy petition and

Q15: On a statement of financial affairs, a

Q16: During a reorganization, cash reserves tend to

Q19: Where should a company undergoing reorganization report

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents