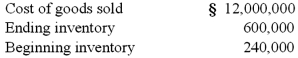

A U.S. company's foreign subsidiary had the following amounts in stickles (§) , the functional currency, in 2011:  The average exchange rate during 2011 was §1 = $.96. The beginning inventory was acquired when the exchange rate was §1 = $1.20. The ending inventory was acquired when the exchange rate was §1 = $.90. The exchange rate at December 31, 2011 was §1 = $.84. At what amount should the foreign subsidiary's cost of goods sold have been reflected in the 2011 U.S. dollar income statement?

The average exchange rate during 2011 was §1 = $.96. The beginning inventory was acquired when the exchange rate was §1 = $1.20. The ending inventory was acquired when the exchange rate was §1 = $.90. The exchange rate at December 31, 2011 was §1 = $.84. At what amount should the foreign subsidiary's cost of goods sold have been reflected in the 2011 U.S. dollar income statement?

A) $11,253,600.

B) $11,577,600.

C) $11,520,000.

D) $11,613,600.

E) $11,523,600.

Correct Answer:

Verified

Q18: In accounting, the term translation refers to

A)

Q18: Certain balance sheet accounts of a foreign

Q19: Certain balance sheet accounts of a foreign

Q19: Dilty Corp. owned a subsidiary in France.

Q26: A U.S. company's foreign subsidiary had the

Q29: Under the current rate method, retained earnings

Q32: Under the current rate method, property, plant

Q33: A historical exchange rate for common stock

Q34: Under the current rate method, depreciation expense

Q39: Which method of translating a foreign subsidiary's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents