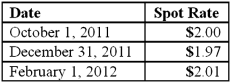

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:  What is the amount of option expense for 2012 from these transactions?

What is the amount of option expense for 2012 from these transactions?

A) $1,000.

B) $1,600.

C) $2,500.

D) $2,600.

E) $0.

Correct Answer:

Verified

Q60: On May 1, 2011, Mosby Company received

Q62: What happens when a U.S. company sells

Q62: On October 1, 2011, Eagle Company forecasts

Q64: What is the purpose of a hedge

Q68: Gaw Produce Company purchased inventory from a

Q70: On October 1, 2011, Eagle Company forecasts

Q72: Yelton Co.just sold inventory for 80,000 euros,

Q74: What happens when a U.S. company sells

Q104: How is the fair value of a

Q105: Where can you find exchange rates between

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents