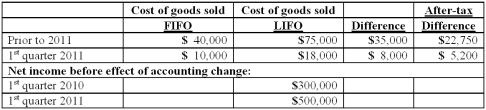

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2011. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2011, how much is reported as net income for the first quarter of 2010?

Assuming Baker makes the change in the first quarter of 2011, how much is reported as net income for the first quarter of 2010?

A) $300,000.

B) $322,750.

C) $335,000.

D) $265,000.

E) $277,250.

Correct Answer:

Verified

Q65: How should seasonal revenues be reported in

Q66: Which of the following costs require similar

Q67: Baker Corporation changed from the LIFO method

Q68: Which of the following are required to

Q72: Provo, Inc. has an estimated annual tax

Q73: Which of the following is reported for

Q75: How should contingencies be reported in an

Q78: What is the appropriate treatment in an

Q79: What is the appropriate treatment in an

Q80: Which of the following is reported for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents