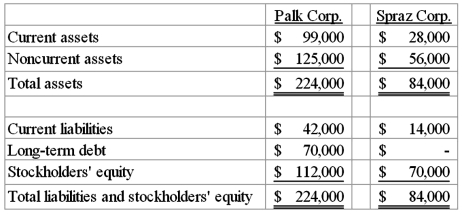

On January 1, 2010, Palk Corp. and Spraz Corp. had condensed balance sheets as follows:  On January 2, 2010, Palk borrowed the entire $84,000 it needed to acquire 80% of the outstanding common shares of Spraz. The loan was to be paid in ten equal annual principal payments, plus interest, beginning December 31, 2010. The excess consideration transferred over the underlying book value of the acquired net assets was allocated 60% to inventory and 40% to goodwill. What is consolidated current assets at January 2, 2010?

On January 2, 2010, Palk borrowed the entire $84,000 it needed to acquire 80% of the outstanding common shares of Spraz. The loan was to be paid in ten equal annual principal payments, plus interest, beginning December 31, 2010. The excess consideration transferred over the underlying book value of the acquired net assets was allocated 60% to inventory and 40% to goodwill. What is consolidated current assets at January 2, 2010?

A) $127,000.

B) $129,800.

C) $143,800.

D) $148,000.

E) $135,400.

Correct Answer:

Verified

Q23: When consolidating a subsidiary that was acquired

Q24: When a subsidiary is acquired sometime after

Q26: When a parent uses the initial value

Q27: Keefe, Inc., a calendar-year corporation, acquires 70%

Q29: On January 1, 2010, Palk Corp. and

Q32: On January 1, 2010, Palk Corp. and

Q34: In measuring non-controlling interest at the date

Q35: When a parent uses the partial equity

Q38: All of the following statements regarding the

Q39: In a step acquisition, which of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents