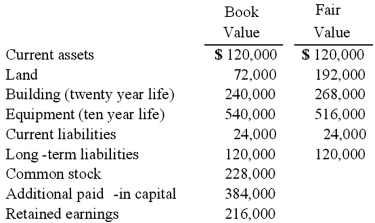

On January 1, 2010, Cale Corp. paid $1,020,000 to acquire Kaltop Co. Kaltop maintained separate incorporation. Cale used the equity method to account for the investment. The following information is available for Kaltop's assets, liabilities, and stockholders' equity accounts:  Kaltop earned net income for 2010 of $126,000 and paid dividends of $48,000 during the year. At the end of 2010, the consolidation entry to eliminate Cale's accrual of Kaltop's earnings would include a credit to Investment in Kaltop Co. for

Kaltop earned net income for 2010 of $126,000 and paid dividends of $48,000 during the year. At the end of 2010, the consolidation entry to eliminate Cale's accrual of Kaltop's earnings would include a credit to Investment in Kaltop Co. for

A) $124,400.

B) $126,000.

C) $127,000.

D) $76,400.

E) $0.

Correct Answer:

Verified

Q2: Which one of the following varies between

Q12: Under the partial equity method, the parent

Q15: Parrett Corp. acquired one hundred percent of

Q17: On January 1, 2010, Cale Corp. paid

Q18: On January 1, 2010, Cale Corp. paid

Q21: When a company applies the partial equity

Q24: Perry Company acquires 100% of the stock

Q25: Red Co. acquired 100% of Green, Inc.

Q27: When consolidating a subsidiary under the equity

Q37: Which of the following statements is false

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents