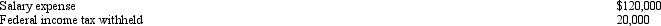

Excel Products Inc.pays its employees semimonthly.The summary of the payroll for December 31,2012 indicated the following:

For the year ended 2012,$40,000 of the December 31 payroll is subject to social security tax of 6%;$120,000 is subject to Medicare tax of 1.5%;$10,000 is subject to state unemployment tax of 4.3% and federal unemployment tax of 0.8%.As of January 1,2013 all of the $120,000 is subject to all payroll taxes.Present the journal entries for payroll tax expense if the employees are paid (a)December 31 of the current year, (b)January 2 of the following year.

Correct Answer:

Verified

Q161: Journalize the following transactions for Riley Corporation:

Q162: Journalize the following transactions: Q163: The following information is for employee Ella Q164: The Core Company had the following assets Q166: Journalize the following entries on the books Q167: On October 1,Ramos Co.signed a $90,000,60-day discounted Q168: The current assets and current liabilities for Q169: Journalize the following entries on the books Q170: For Company A and Company B: Q171: Aqua Construction installs swimming pools. They calculate

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents