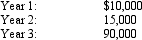

Sabas Company has 20,000 shares of $100 par,1% non-cumulative preferred stock and 100,000 shares of $50 par common stock.The following amounts were distributed as dividends:

Determine the dividends per share for preferred and common stock for each year.

Correct Answer:

Verified

Q144: Prepare entries to record the following:

Q145: A corporation,which had 18,000 shares of common

Q146: Sabas Company has 40,000 shares of $100

Q147: On January 1,2011 a company had the

Q150: Morocco Inc.reported the following results for the

Q151: A corporation was organized on January 1

Q151: Vincent Corporation has 100,000 share of $100

Q153: Sabas Company has 20,000 shares of $100

Q171: On April 10, a company acquired land

Q175: On May 1, 10,000 shares of $10

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents