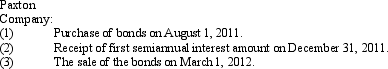

On August 1,2011,Airport Company sold Paxton Company $1,000,000 of 10-year,6% bonds,dated July 1 at 100 plus accrued interest.On March 1,2012,Paxton sold half of the bonds for $520,000 plus accrued interest.Present entries to record the following transactions:

Correct Answer:

Verified

Q104: On October 1, 2012, Marcus Corporation purchased

Q110: The income statement for Dodson Corporation reported

Q111: Gerardo Company had a net income of

Q115: On April 1, 2015, ValueTime, Inc. had

Q116: Prepare the journal entries for the following

Q118: Sutton Company purchased 10% of the outstanding

Q119: Present entries to record the following selected

Q120: On January 1, 2012, Valuation Allowance for

Q127: (1) Discuss factors contributing to the trend

Q161: Discuss the similarities and differences in reporting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents