Grizzly Company Grizzly Company Manufactures Footballs.The Forecasted Income Statement for the Year

Grizzly Company

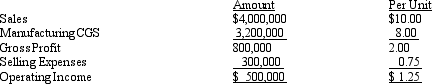

Grizzly Company manufactures footballs.The forecasted income statement for the year before any special orders is as follows:

Refer to Grizzly Company.Fixed costs included in the above forecasted income statement are $1,200,000 in manufacturing CGS and $100,000 in selling expenses.Grizzly received a special order offering to buy 50,000 footballs for $7.50 each.There will be no additional selling expenses if Grizzly accepts.Assume Grizzly has sufficient capacity to manufacture 50,000 more footballs.The unit relevant cost for Grizzly's decision is

A) $8.00

B) $5.00

C) $8.75

D) $5.75

Correct Answer:

Verified

Q30: The value chain influences long-run pricing decisions

Q31: What costs can be justified when managers

Q32: In the short run,_ limitations require choices

Q33: What costs can be justified when a

Q34: Which of the following is true about

Q36: In the short run,the practice of setting

Q37: Which product pricing practice is used by

Q38: Which product pricing factor is primarily used

Q39: Which of the following is false about

Q40: Which of the following influences should not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents