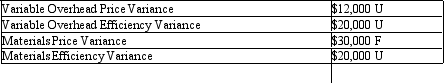

Solving for materials and labor.Clayton Company makes fireplace screens.Under the flexible budget,when the firm uses 75,000 direct labor hours,budgeted variable overhead is $75,000,whereas budgeted direct labor costs are $450,000.The company applies variable overhead to production units on the basis of direct labor hours.All data apply to the month of February.The following are some of the variances for February (F denotes favorable;U denotes unfavorable):

During February,the firm incurred $400,000 of direct labor costs.According to the standards,each fireplace screen uses one pound of materials at a standard price of $4.00 per pound.The firm produced 100,000 fireplace screens in February.The materials price variance was $0.30 per pound,whereas the average wage rate exceeded the standard average rate by $0.50 per hour.

Required:

Compute the following for February,assuming there are beginning inventories but no ending inventories of materials:

a.pounds of materials purchased

b.pounds of material usage over standard

c.standard hourly wage rate

d.standard direct labor hours for the total February production

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: Overhead variances.Trevor,Inc. ,uses standard costing.The company reported

Q89: Solving for labor hours.Lance's Engineering Consulting reports

Q90: Solving for labor hours.Bill's Engineering Consulting reports

Q91: Houser Parcel Moving Express reports the following

Q92: Overhead variances.Upton,Inc. ,uses standard costing.The company reported

Q94: How are fixed manufacturing costs treated for

Q95: Hightown Company uses a predetermined overhead rate

Q96: Estimating flexible selling expense budget and computing

Q97: Materials and labor variances.The Chocolate Factory presents

Q98: Sally's Delivery Company reports the following information

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents